This one-of-a-king prototype generously lent to PAI is a phenomenal example of Philip Stein's upcoming foray into Palladium. The legendary watchmaker is yet another company embracing The Now Metal™ as the white metal of the future.

Interesting article today in Seeking Alpha (links to original). Brad Zigler looks at where Palladium was and how supply may affect its price by next summer. The article also mentions a positive development at Stillwater Mining Co., the main mine behind Palladium Alliance International: Labor negotiations have been settled.

**************

By Brad Zigler

In times of market stress, investors often catch themselves wistfully remembering the "good ole days." That is, between bouts of frantic selling.

I found myself looking backward, too, when a report came over the transom about a new labor contract being forged at Stillwater Mining Co.'s (NYSE: SWC) East Boulder operation.

We'd looked at Stillwater back in December (see "Platinum's Poorer Relation: Palladium"), and again in February (see "Following The Other White Metal") when platinum group metals were on a tear.

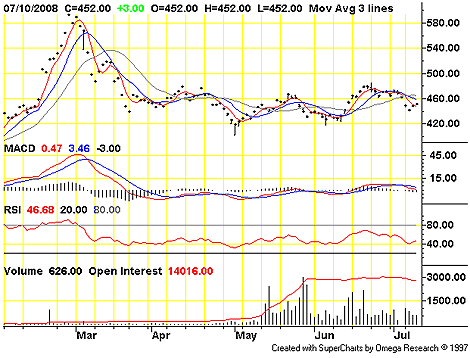

Palladium, it turns out, peaked on February 28 at $593.70 an ounce, basis the NYMEX September contract. The September delivery settled at $452 Thursday.

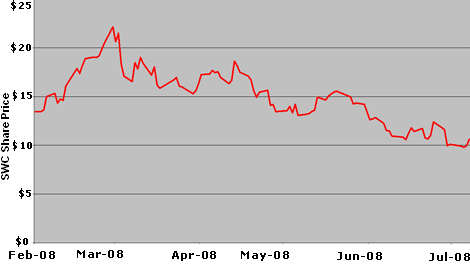

Stillwater's stock took a similar roller coaster ride. Topping out over $22 a share in early March, Stillwater fell below $10 when labor talks stalled.

There'd been no strike at the company's Montana mine, though negotiations between Stillwater and the USW International Union, which represents mine workers, went to the wire. In fact, talks went past the wire. The expiring labor agreement ran out at the end of June, but the two sides agreed to extend talks another couple of weeks.

Stillwater's stock wobbled a lot as talks moved into the terminal phase, first swooning, then finding buyers at ten bucks. Stillwater shares ended Thursday's session at $10.61, after a two-day rally that boosted the stock 8%.

Fundamentals for palladium, says analyst Shawn Hackett of Hackett Financial Advisors, are "very bullish." Recession fears, he admits, have kept the metal's price in check, trumping "the positive implications for a massive shift in substitution demand for catalytic converters and jewelry," says Hackett.

Declines in Russian production and the drawdown in stockpiles should also shape up as bullish factors. Hackett's looking at a target over $800 an ounce by next summer if Russian supplies hold out and stretch to $1,000 an ounce if stocks are completely depleted.

Gee. That'll make these the good ole days.

Casting Consultant Linus Drogs and Bench Consultant Chris Ploof, the tech wizards for Palladium Alliance International, will present at the upcoming JA Summer Show in New York City.

Casting Consultant Linus Drogs and Bench Consultant Chris Ploof, the tech wizards for Palladium Alliance International, will present at the upcoming JA Summer Show in New York City.

A bit nerdy, but it is Monday. A new issue of Johnson Matthey's Platinum Metals Review is up on the web. JM is the world's largest assayer & refiner; they're the guys who make those beautiful Palladium alloy blocks that jewelers turn into Palladium rings, watches, necklaces, cuffs and more.

Some of the topics are the company's new sustainability initiatives, new Palladium-based catalysts, and other fun stuff. Full text available soon, so for now you'll have to do with a summary.

From Platinum Today, a publication by assayer & refiner Johnson Matthey, is an interesting little science tidbit about Palladium:

"Nippon Seisen has developed a separation membrane, made from palladium, for extracting high-purity hydrogen from natural gas.

The membrane is constructed from a 15-micron-thick film of a palladium alloy that is welded into a smooth cylinder shape.

When it comes into contact with hydrogen, the molecule splits into separate hydrogen atoms which can then pass through the spaces between the alloy.

As a result, the new technology is able to achieve a yield of more than 99.9999 per cent pure hydrogen.

No special equipment is necessary because hydrogen is the only substance that can pass through the membrane, allowing machinery using hydrogen to be designed cheaper and smaller.

The technology could be used in a range of devices that could hit the market in 2009.

Nippon Seisen is expected to develop it for use in fuel cells for cars and homes."

A little business, a little pleasure is what you get this morning. On the business end, demand for Palladium and Stillwater Mining Company (the Montana mine that supports Palladium Alliance International) are discussed in a Seeking Alpha series called "The Brightest Stars in the Commodities Boom" ... Mark Anthony is one of those writers heavily invested in the companies under discussion, so he's very enthusiastic, but I think he's usually on point.

Dozens of newspapers this week carried an AP article on catalytic convertor theft. The traces of Palladium and Platinum they contain are valuable at the scrap yard. More interesting, however, are the measures some buyers are taking to insulate themselves from trouble.

And now for the pleasure... the beautiful Ulysse Nardin Macho Palladium 950, made completely of pure Palladium. On the wrist it feels formidable, and its shine is outrageous - just a stunning watch. Worth every penny of its $30,000 retail price.

By Eric Roseman

No other precious metal has a tighter supply than platinum.

Though platinum prices have remained high over the last few years, supplies are getting thinner by the day as South African production draws to a standstill. Lately, these tight supplies have helped platinum prices shoot up north of US$2,000.

In fact, platinum has climbed so high that its sister metal, palladium is becoming the new exciting speculation. Right now, palladium is sitting at 56% off its all-time high in 2001 of US$1,100 an ounce. The platinum-to-palladium differential hit its widest level in history in late May as platinum prices rocketed to new highs.

So the question is: Has the price of platinum climbed so high that industries will start switching to palladium?

......Read the full article

By CAROLYN CUI

July 8, 2008; Page C14

Gold and silver bugs, move over.

Investors are flocking to a new class of precious metals: the kind that actually do things, rather than end up in vaults or on fingers.

Platinum prices have soared 30% this year and its cheaper cousin, palladium, has risen 19%, largely on demand for cleaner cars. A flood of new investment vehicles -- including exchange-traded funds -- that allow investors to bet on these metals' trajectory also are fueling the market.

[Metals]

The two metals are called "precious" because of their scarcity. Platinum jewelry has long been a higher-end alternative to gold. But unlike gold, platinum isn't viewed as a prime refuge for investors in times of uncertainty.

.... Read the full article