Tuesday, September 9, 2008

Stillwater Mining in the News

Read "Seven Montana Stocks"

Wednesday, September 3, 2008

Seeking Alpha: Of Wars & Strategic Metals

An excerpt from a new article by Mark Anthony on Seeking Alpha. Anthony is a big proponent of Palladium and Stillwater Mining Co. Read the full article here.

OF WARS AND STRATEGIC METALS

by Mark Anthony

...Platinum is way better than gold, while palladium is better than platinum due to current price disparity. Unfortunately, physical palladium coins and bars are now extremely hard to find. If you like the PGM metals, consider buying the stocks of Stillwater Mining (SWC) and North American Palladium (PAL). They are the ONLY primary PGM metals mining companies outside South Africa and Russia. Russia, being the dominant palladium producer, can cut back export and boost the palladium price at any time, in their own interests. South Africa continues to struggle with a national electricity crisis which greatly impacts the output of its PGM mining industry...

Wednesday, July 23, 2008

Stillwater Mining Aids River Weed Project

********

Weed effort shows signs of progress

By LINDA HALSTEAD-ACHARYA

Of The Gazette Staff

NYE - What a difference a year makes. That was the report from Noel Keogh, the Nye rancher who along with several others has spearheaded a cooperative weed control project on the upper Stillwater River.

Last summer marked the first year of a three-year grant aimed at controlling noxious weeds from the Woodbine Campground to the Nye School. This summer marked a noticeable difference.

"We covered the same land," Keogh said. "Only this year, there was only about 5 percent of the weeds."

......(Click to read the full article)

Thursday, July 17, 2008

Seeking Alpha: Best Safe-Haven Investments

Mark Anthony over at Seeking Alpha wrote another (very long) article on his favorite commodities invetments. He's a long-time champion of Palladium and Stillwater Mining Company, and while this one turns into a tome, it's worth reading his analysis of Stillwater.

Read the full-text here

Tuesday, July 15, 2008

Seeking Alpha: Good Ole Day for Pallladium?

Interesting article today in Seeking Alpha (links to original). Brad Zigler looks at where Palladium was and how supply may affect its price by next summer. The article also mentions a positive development at Stillwater Mining Co., the main mine behind Palladium Alliance International: Labor negotiations have been settled.

**************

By Brad Zigler

In times of market stress, investors often catch themselves wistfully remembering the "good ole days." That is, between bouts of frantic selling.

I found myself looking backward, too, when a report came over the transom about a new labor contract being forged at Stillwater Mining Co.'s (NYSE: SWC) East Boulder operation.

We'd looked at Stillwater back in December (see "Platinum's Poorer Relation: Palladium"), and again in February (see "Following The Other White Metal") when platinum group metals were on a tear.

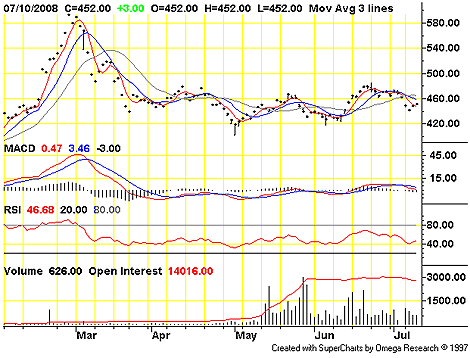

Palladium, it turns out, peaked on February 28 at $593.70 an ounce, basis the NYMEX September contract. The September delivery settled at $452 Thursday.

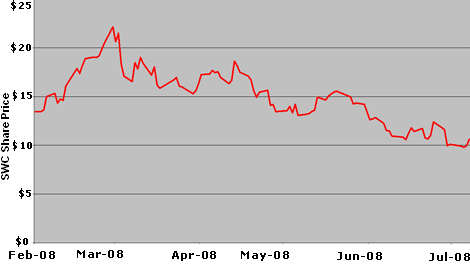

Stillwater's stock took a similar roller coaster ride. Topping out over $22 a share in early March, Stillwater fell below $10 when labor talks stalled.

There'd been no strike at the company's Montana mine, though negotiations between Stillwater and the USW International Union, which represents mine workers, went to the wire. In fact, talks went past the wire. The expiring labor agreement ran out at the end of June, but the two sides agreed to extend talks another couple of weeks.

Stillwater's stock wobbled a lot as talks moved into the terminal phase, first swooning, then finding buyers at ten bucks. Stillwater shares ended Thursday's session at $10.61, after a two-day rally that boosted the stock 8%.

Fundamentals for palladium, says analyst Shawn Hackett of Hackett Financial Advisors, are "very bullish." Recession fears, he admits, have kept the metal's price in check, trumping "the positive implications for a massive shift in substitution demand for catalytic converters and jewelry," says Hackett.

Declines in Russian production and the drawdown in stockpiles should also shape up as bullish factors. Hackett's looking at a target over $800 an ounce by next summer if Russian supplies hold out and stretch to $1,000 an ounce if stocks are completely depleted.

Gee. That'll make these the good ole days.

Thursday, July 10, 2008

Palladium: One Hot Commodity

A little business, a little pleasure is what you get this morning. On the business end, demand for Palladium and Stillwater Mining Company (the Montana mine that supports Palladium Alliance International) are discussed in a Seeking Alpha series called "The Brightest Stars in the Commodities Boom" ... Mark Anthony is one of those writers heavily invested in the companies under discussion, so he's very enthusiastic, but I think he's usually on point.

Dozens of newspapers this week carried an AP article on catalytic convertor theft. The traces of Palladium and Platinum they contain are valuable at the scrap yard. More interesting, however, are the measures some buyers are taking to insulate themselves from trouble.

And now for the pleasure... the beautiful Ulysse Nardin Macho Palladium 950, made completely of pure Palladium. On the wrist it feels formidable, and its shine is outrageous - just a stunning watch. Worth every penny of its $30,000 retail price.